|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Best Time to Refinance Home and Maximize BenefitsRefinancing your home can be a strategic financial move, but timing is everything. Knowing when to refinance can save you money, reduce your interest rate, and even lower your monthly payments. This guide will help you understand the best time to refinance your home by exploring various factors and scenarios. Interest Rates and Market ConditionsMonitoring Market TrendsInterest rates fluctuate due to various economic factors. Keeping an eye on the market can help you seize the opportunity when rates are favorable. Lower interest rates can significantly reduce your mortgage costs over time. Economic IndicatorsFactors such as inflation, employment rates, and the Federal Reserve's policies can impact mortgage rates. Stay informed about these indicators to make an educated decision. Personal Financial SituationCredit ScoreA strong credit score can qualify you for better refinancing rates. Check your credit report for errors and take steps to improve your score before applying. Debt-to-Income RatioYour debt-to-income ratio is a crucial factor lenders consider. Aim to lower your debts and increase your income to enhance your refinancing prospects. When Not to Refinance

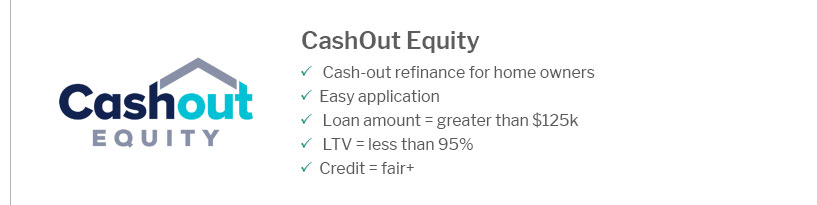

Exploring Refinance OptionsConsider different refinancing options like the maximum fha cash out refinance ltv which can provide access to your home’s equity, offering financial flexibility. FAQs on Refinancing

In conclusion, understanding the best time to refinance your home involves considering both market conditions and personal financial circumstances. By staying informed and evaluating your options, you can make a decision that aligns with your financial goals. https://www.businessinsider.com/personal-finance/mortgages/when-to-refinance-mortgage

Generally speaking, now isn't an ideal time for most borrowers to refinance, because rates are still higher than what most borrowers are paying. https://www.investopedia.com/is-now-a-good-time-to-refinance-your-mortgage-8691145

Experts recommend that homeowners wait a bit longer to refinance their homes if possible since refinance rates are likely to fall further if the ... https://www.discover.com/home-loans/articles/should-i-refinance-mortgage/

Ultimately, the best time to refinance a mortgage is when you financially benefit from refinancing. This means you should probably wait to ...

|

|---|